Economic Calendar

Our economic calendar is a valuable tool for traders who want to stay up-to-date on the latest market news and events.

What Is the Economic Calendar

In forex, the economic calendar is a list of significant financial events such as economic indicators, monetary policy decisions, and other releases that may affect specific currency pair rates or the trading market as a whole.

The news releases are well-known for having a big impact on the forex market. The economic calendar is a tool that traders may use to learn about the underlying factors that may impact their trading in the coming days. The Consumer Price Index (CPI), the Non-Farm Payroll (NFPs), and other indicators of the most important economic elements are generally incorporated into the economic calendar. It also has details about the Central Bank’s most recent announcements and meetings that are coming up.

An updated and easy-to-understand calendar, like MyForexReport, helps traders develop trading and investment strategies.

How to Read the Economic Calendar?

Now that you already know how to use the economic calendar and know which options are available where, let’s explore how to read the calendar properly.

The Events

Events are the reasons why you need an economic calendar and also why are you here reading this complete guide to the economic calendar. Events include the listing title of announcements. When you click on a particular event, a full report with extensive details about that specific event is displayed.

Timetable / the Schedule

Now you need to know when, where and which currency is related to the announcement of the event. The arrows under the ‘Local’ and ‘Currency’ let you choose the timezone and the currency respectively.

Impact

Impact in terms of economic calendar guides you to acknowledge the importance of specific event announcements. Generally, they are listed among the LOW/MEDIUM/HIGH range of impact. Low impact indicates that the event is not a significant market mover, but high impact indicates that the event may create abrupt changes and market volatility and should be attentively followed.

Forecast

Now we’re at the forecast, the equation of what happened, what’s happening, and what’s going to happen. The ACTUAL column is responsible for portrayal of current market condition where the future forecast is found under the FORECAST column and the previous condition is depicted by the PREVIOUS column.

Filter

If you want to search for selective information from an economic calendar then this option of filtering will help you greatly. All these options are filterable. You may just click on them and search for the individual information you’re seeking to know about.

Frequently Asked Questions

The advantages of an economic calendar are widely dispersed. First off, it prevents traders from being taken off guard when new data is disclosed. When significant events like the NFP and Fed decision arrive, many traders would be taken by surprise if there were no calendar.

Second, it facilitates strategy development. Having a calendar will assist you get to choose the technique to use. To give you an idea, you might apply the scalping strategy occasionally if there is important economic data. Use the swing trading approach if there are no significant data spots.

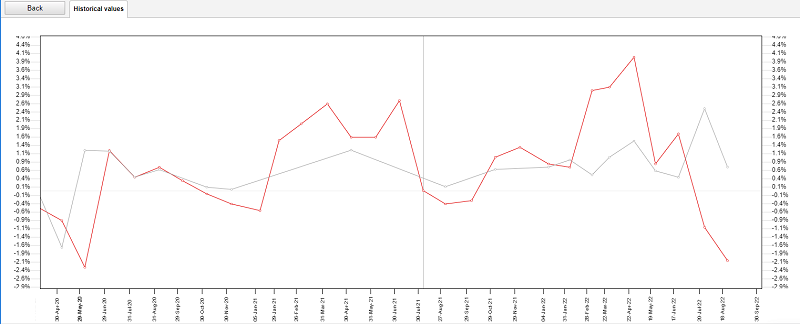

Thirdly, it enables you to analyze the facts and take appropriate action. For instance, if we need to know the Consumer Price Index (YoY) history in Canada, the listing of the Consumer Price Index will show us how the history of the index has changed over time with precise values.

The economic calendar works as a tool to analyze the fundamental factors for traders. So a trader needs to understand how they should read the calendar. Most pro traders check the calendar before initiating open trades. This contains all announcements and potentially affected currencies along with their precise times. In effect, it predicts when and how much market volatility to expect.

In the MyForexReport economic calendar, you may experience that we have the most updated listings of upcoming events in a customizable manner. So how does it help? First, unlike other static economic calendars, we made it interactive for you. So you may choose to see the listings of previous or past events as well as the future. Besides, you have the full operational options to see listings by country and the level of impact they are going to have.

Putting these snippets of good things we have together, let’s guide you through our economic calendar and how you use it.

Firstly, when you browse, you will be taken to our economic calendar page. In the first row you’ll find the events’ days/dates/weeks. The country’s customization is located here in the upper right corner.

Later, when you’re eyeing the next row you may see what we have on our calendar. It has the country, local time, currency, event details, the level of impact, present condition, future forecast, and obviously the previous state. It includes the country, local time, currency, event information, impact level, current state, future prospects, and clearly the previous state. Now, following your trading strategy, you should look for the information you need. Then, you must compare your plan with the effects of the economic forecast and other factors.

Traders that don’t bother to trade with an economic calendar fall into one of two groups. The first group of them includes traders who just focus on technical analysis, and the second group includes new traders. Technical traders have to take a peek at the calendar even though they don’t bother to follow the economic calendar in order to be aware of their preferred trading approach, exiting the market when a significant announcement is about to be released. Why do they do that? They play it safe and don’t trade in such a volatile market because there’s no way to know how the price of a pair will change when an announcement is made.

In other words, experienced traders look for such announcements to open trade. Experienced traders take it as an opportunity to scale up their profit within that announced effect of price movement. Even though this could be a good way for an experienced trader to make money, we strongly suggest that new traders don’t trade during these times.

The Forex market in itself is a market that is influenced by news and geopolitical events around the world. A macro release can have a significant impact on the market. Because of this, it’s important for traders to keep up with the upcoming events and the importance of the release. To be successful, you must balance your strategy with fundamental and technical factors.

Since the forex market is the most volatile market and news, announcements have a significant impact on market movement, traders need to be aware of upcoming events to adjust their trading approach. Developing your strategy with the events on the economic calendar in mind will help you make profitable trades.

Successful traders have a tendency to check the calendar every morning before they open or close a trade. But many other traders also recommend taking a look at the calendar before going to bed after a profitable trading day.

There are many economic events that affect the stock market. We are listing below some of the most significant of them below:

I. Inflation and Interest Rates

II. Impact of Exchange Rates

III. The Effects of Global Events

IV. Internal Developments Within Companies

V. Financial Reports and Hype

There are economic calendars that are not dynamic and updated minutely in real-time. MyForexReport has introduced the most updated economic calendar, loaded with all the tools and data needed. The real-time calendar presents global financial events and indicators. When new information is made available, it gets automatically updated. The Real-time calendar does not serve as a trading guide; it just offers general information needed to plan a trading strategy accordingly.