Last Updated on May 31, 2025 by Richard Gibson

MyForexFunds used to be the top prop firm out there. Most firms today follow their model. However, in 2023, they got into a legal battle and shut their services down. Until they are back on business, we at MyForexReport decided to remove our article, where we disclosed our real-life experience with their account.

However, when we went through our backend search quarry, we found many traders who wanted to know about MFF and whether they would be back in action. With that in mind, my team and I went through their case files. I will summarise here what is happening with them ( as simply as I can). I will put that info here if there is any update about the case or if MFF decides to return.

What Happened to MyForexFunds

On August 29, The Commodity Futures Trading Commission (CFTC) filed a lawsuit in New Jersey against Murtuza Kazmi and his company, Traders Global Group Inc. (operating as “My Forex Funds”). They are accused of fraudulently soliciting customers to trade in leveraged foreign exchange (forex) and commodity transactions.

On August 29, a judge froze the defendants’ assets and appointed a temporary receiver to review their financial records. The CFTC aims to recover money for defrauded investors, impose fines, and permanently ban the defendants from trading and further violations. The defendants allegedly lured over 135,000 customers into their trading program by promising them a share of profits. Instead, they manipulated trades to ensure losses and profited from customer fees totaling at least $310 million. Kazmi allegedly used this money to buy luxury items and transfer millions to personal accounts.

MyForexFunds Court Case Update (May 2025)– CFTC Case Dismissed

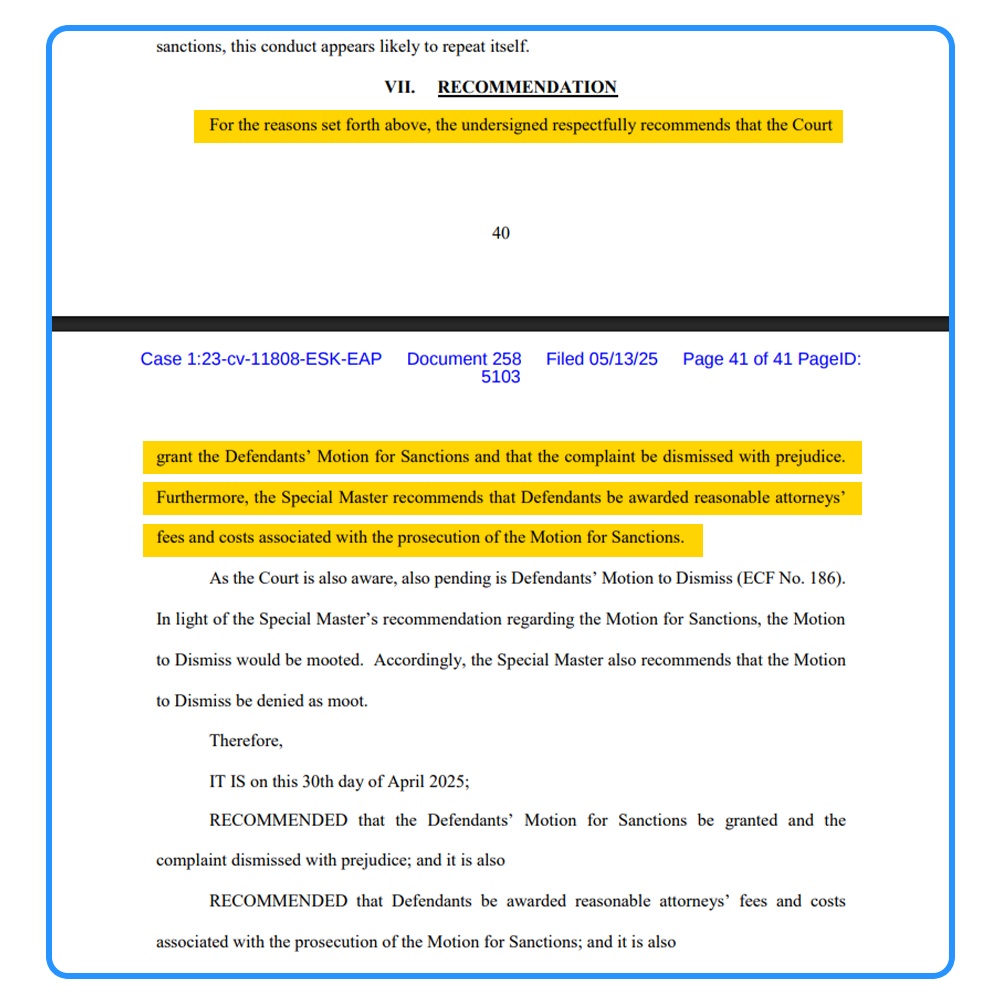

The court dismissed the CFTC’s complaint against Traders Global Group Inc. (MyForexFunds’ parent company) with prejudice, meaning the CFTC cannot refile the same charges. Additionally, the court approved a sanctions motion against the CFTC, ordering them to pay MyForexFunds’ legal fees related to the sanctions motion.

This outcome is a significant victory for MyForexFunds and a serious blow to the CFTC’s case and reputation.

So in Short

While the court has unfrozen assets to allow payments to existing traders, My Forex Funds’ operations have not yet resumed. This ruling, coupled with the court’s view that “simulated trading” involving real money has regulatory implications is pushing for greater legal clarity and regulation for forex prop firms, especially in the USA.

MyForexFunds Court Case Update FAQs

It is hard to say for now. However, most of their assets are unfrozen so that they can pay back their existing traders. The court ruled that all prop firms fall under the regulations of the CFTC. So MFF can come alibit they have to maintain the rules set out by CFTC. It is only a matter of time.

MyForexFunds’s headquarters is situated in Ontario, Canada.

After a quick analysis of all existing prop firms, we found that The5ers and FXIFY are the best alternatives for MyForexFunds. They closely resemble MFF in that both firms provide MetaTrader. Like MFF, you can deposit a minimum of $39 (FXIFY) and $39 (The5ers) to get your funded account of $5000 or read our real-time experience to know about their services.

Richard Gibson is a trade analyst and writer for MyForexReport. He has over 10 years of experience in investing and trading equities, options and bonds. He trades options, stocks, and ETFs regularly following a value-driven investment philosophy. He’s a graduate of the University of MacEwan University, and holds a graduate certificate in financial planning from the University of Calgary.

Forum Profiles: Babypips