Proprietary firms are here to offer funds to the traders but the key factor here is if the funds they are providing are really helping the traders to its full potential. Considering the question in mind, I traded The Funded Trader to have the answer.

- Max 90% profit splits

- Arranges exciting events and competitions

- Multiple models to choose

- Good customer support

- EA's, copiers, and risk management tools are allowed

- 6%DD 12% max drawdown

- No Free trial or demo checking option

- High commision

Last Updated on July 6, 2024 by Richard Gibson

TFT is currently unavailable. We will update our review when they are back online.

The first and most important thing I do and what I advise traders to do is run a background check. You may get a quick idea of how it all might be in the long – run by having a look at its background. Let’s find out…

The company, which has a fascinating backstory, has always lived up to its reputation with its offers and, in my opinion, the way it treats its funded traders.

The Background of The Funded Trader (TFT)

The Funded Trader is a USA-based Forex Prop Firm, offering its services globally. They operate from Texas and Mr. Angelo Ciaramello, one of the popular faces in the trading industry is The Funded Trader’s CEO. Although they started funding traders in 2020, they incorporated in May 2021.

People Behind The Funded Trader

As you already know the frontman, Angelo Ciaramello. The other two mentionable key names are Nick D’Arcangelo and Blake Olson. They all are the co-founders and managing members of TFT, The Funded Trader.

The Funded Trader Legal Information:

| Business Name | The Funded Trader LLC |

| Popular Name | The Funded Trader |

| Company Number | 0804062482 |

| CEO | Angelo Ciaramello |

| Commenced Operation | 2020 |

| Incorporation Date | May 12, 2021 |

| Organizational Type | Domestic Limited Liabilities Company(LLC) |

| Effective SOS Registration Date | 05/12/2021 |

| Texas SOS File Number | 0804062482 |

| Country | United States of America |

| Mailing Address | 14001 W STATE HIGHWAY 29 STE 102 LIBERTY HILL, TX 78642-2251 |

As a trader which offer do you first search for in a forex proprietary firm? Do let me know in the comments. To me, it’s always the offered account type and the fees. Let’s find out

What Are the Funded Trader Account Types?

The Funded Trader has 3 types of account offerings, Standard Challenge, Rapid Challenge, and Royal Challenge account. The Standard Challenge and Rapid Challenge come in two variants. Regular challenge and Swing Challenge account.

I signed up for a 100K Standard Challenge Account. As a professional trader and as a trader of MyForexReport, I’m always encouraged to take on tough challenges. Before you read my experience, you may just check out their account offerings below.

| Standard Challenge Swing Account | |||||

| Account Balance | $25K | $50K | $100K | $200K | $400K |

| Challenge Leverage | 1:60 | 1:60 | 1:60 | 1:60 | 1:60 |

| Minimum Trading Days | 3 | 3 | 3 | 3 | 3 |

| Phase 1 Target (35 Days) | $2,500 USD(10%) | $5,000 USD(10%) | $10,000 USD(10%) | $20,000 USD(10%) | $40,000 USD(10%) |

| Phase 2 Target (60 Days) | $1,250 USD(5%) | $2,500 USD(5%) | $5,000 USD(5%) | $10,000 USD(5%) | $20,000 USD(5%) |

| Max Loss | $3,000 USD(12%) | $6,000 USD(12%) | $12,000 USD(12%) | $24,000 USD(12%) | $48,000 USD(12%) |

| Max Daily Loss | $1,500 USD(6%) | $3,000 USD(6%) | $6,000 USD(6%) | $12,000 USD(6%) | $24,000 USD(6%) |

| Profit Split | 80% | 90% with Scaling | 80% | 90% with Scaling | 80% | 90% with Scaling | 80% | 90% with Scaling | 80% | 90% with Scaling |

| Weekend Holding | Yes | Yes | Yes | Yes | Yes |

| Refundable Fees | $189 USD | $315 USD | $549 USD | $949 USD | $1898 USD |

| Standard Challenge Regular Account | |||||

| Account Balance | $25K | $50K | $100K | $200K | $400K |

| Challenge Leverage | 1:200 | 1:200 | 1:200 | 1:200 | 1:200 |

| Minimum Trading Days | 3 | 3 | 3 | 3 | 3 |

| Phase 1 Target (35 Days) | $2,500 USD(10%) | $5,000 USD(10%) | $10,000 USD(10%) | $20,000 USD(10%) | $40,000 USD(10%) |

| Phase 2 Target (60 Days) | $1,250 USD(5%) | $2,500 USD(5%) | $5,000 USD(5%) | $10,000 USD(5%) | $20,000 USD(5%) |

| Max Loss | $3,000 USD(12%) | $6,000 USD(12%) | $12,000 USD(12%) | $24,000 USD(12%) | $48,000 USD(12%) |

| Max Daily Loss | $1,500 USD(6%) | $3,000 USD(6%) | $6,000 USD(6%) | $12,000 USD(6%) | $24,000 USD(6%) |

| Profit Split | 80% | 90% with Scaling | 80% | 90% with Scaling | 80% | 90% with Scaling | 80% | 90% with Scaling | 80% | 90% with Scaling |

| Weekend Holding | No | No | No | No | No |

| Refundable Fees | $189 USD | $315 USD | $549 USD | $949 USD | $1898 USD |

TFT Funding Evaluation Phases

The Funded Trader, for the standard regular account, asked to complete a two-phase evaluation before getting funded. The evaluation goals seemed very reasonable for a forex trader, at least to my understanding. So in Phase 1, I had 35 days in hand to complete, with a 10% profit target to be met. The drawdown is something I’ve always feared of and luckily they kept it within 6%, so I could actually risk a maximum of 6% of my account or existing balance, which I narrowly escaped for many days. In my whole phase-1 trading, I almost hit 9% on the overall loss margin. As I was saying that I escaped the margin quite narrowly, this also happened in the overall drawdown as they set the bar of 12%. Do remember that you’ll have to trade at least 3 days a week. This was all from my phase 1 experience.

I got 24hrs to prepare mentally for the phase-2 challenge. According to my experience, phase 2 was a lot easier to manage. The profit target was 5% and that too be met with a 60 days time in hand. The maximum daily loss was still 6% and I did 3% odd on average. The overall loss limit was still 12% and at the end of phase 2, I found that I only hit 4% of overall losses. Hey Marco! Are you still not proud of me? So basically, I passed both phases quite comfortably with quite a good fistful of cash on the board.

For your understanding, I’m just highlighting the part from the Evaluation Phase.

| Maximum/Minimum Trading Day | The Funded Trader doesn’t have any maximum trading day restriction but you need to trade at least 3 days for both phases, if you trade Standard Regular Account |

| Maximum Daily Loss | With The Funded Trader, you are not allowed to lose more than 6% per day in the Standard Regular Account. |

| Maximum Loss | The limit to overall loss is 12% of your account balance. You won’t be able to lose more than $10,000 completely if you are funded with a $100,000 account. |

| Profit Target | In Phases 1 and 2, the Profit Target in The Funded Trader accounts is set to 10% and 5% respectively. |

| Copy Trading | Allowed if you use your TFT account as a master account. It should be done within the TFT network. |

| Trading on Expert Advisor | Not Allowed considering the risk factors involved. |

Trading Assets and Instruments

The Funded Trader offers indices, forex, and, commodities as tradeable instruments. The instruments in particular can be found here. Besides, The Funded Trader used to allow trading crypto but they have terminated it since May this year.

The Funded Trader Spreads

The Funded Trader uses the server of EightCap, the popular forex broker for prop traders. The spread a TFT trader see is right from the server of EightCap. Like me you can also check their spreads in real-time using the following credentials.

| Server | EightcapLtd-Demo2 |

| Login | 917944 |

| Password | yjsetj3z00 |

| Platform Download Link | Click to Download |

The Funded Trader Dashboard Tour (Real Account )

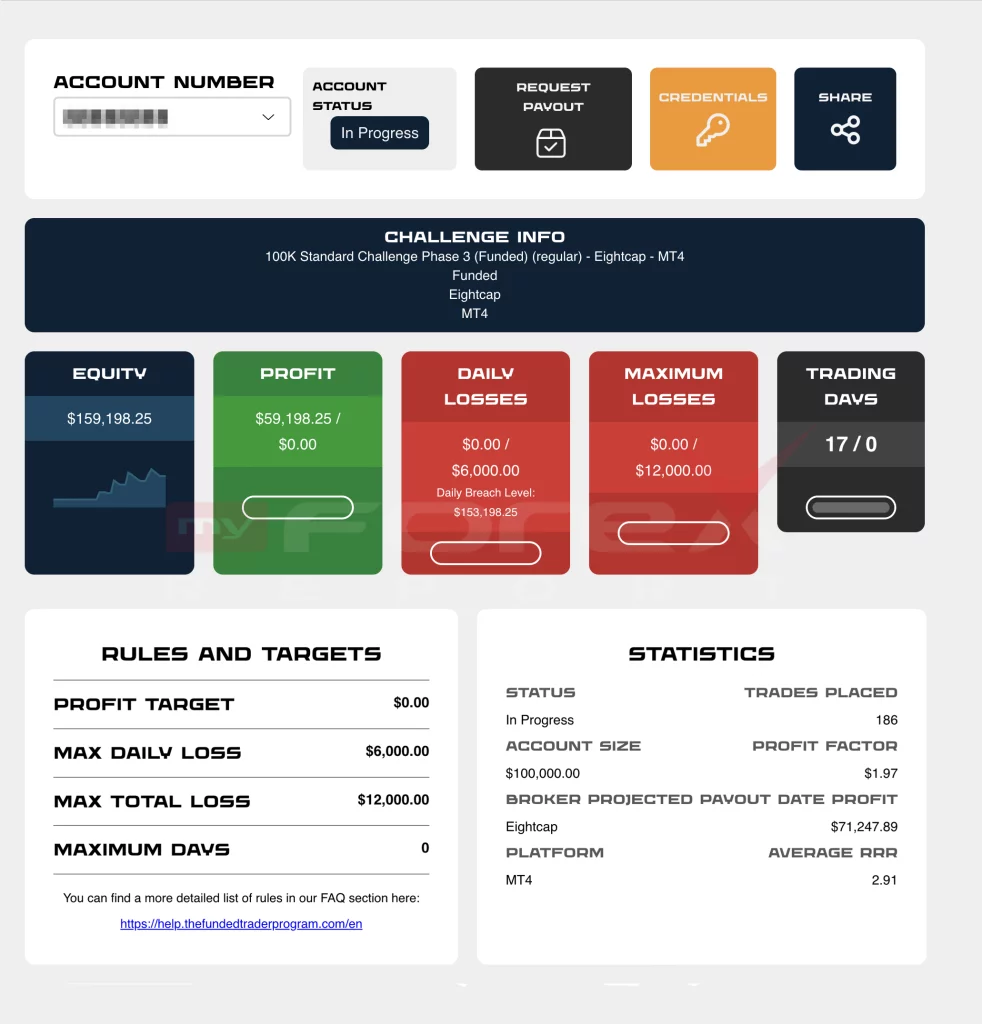

Funded Trader Program undoubtedly has one of the finest dashboards I’ve seen in prop firms. I’ve always prioritised this feature of having a well-informed and easy-to-read dashboard. When you find a prop firm who has such a trader friendly dashboard, you certainly get to know if they will care for you in the long run or not since they shouldn’t make things complicated for you.

However, in the picture below you can see my dashboard from The Funded Trader, As you can see, they have kept it simple, easy to understand and read. The important figures are very nicely placed with realtime appropriate data. Do you think I’m exaggerating? I’m certainly not, the dashboard is literally that good.

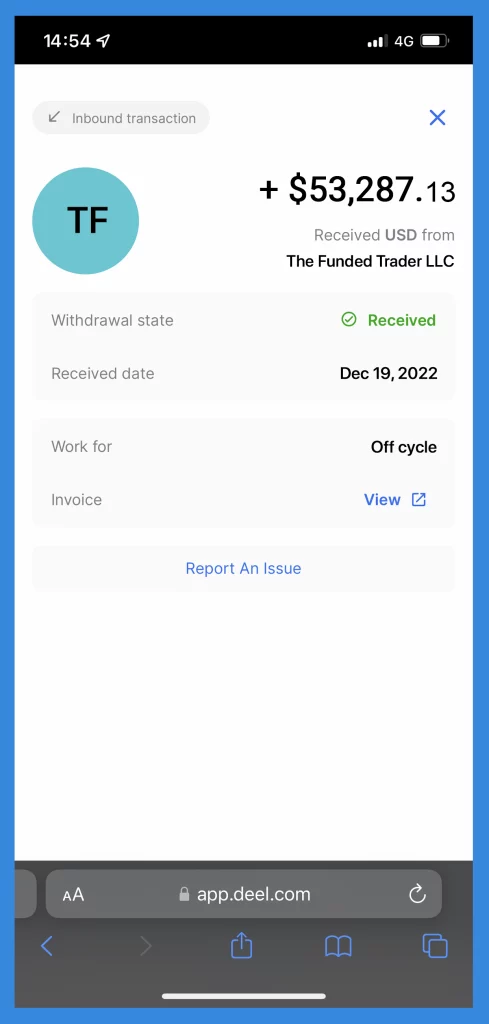

Payment Proof and Profit Split

The Funded Trader Education, Tools, and Application

A trader-friendly firm not only has to have an outstanding funding model that benefits traders, but they also have the responsibility to take care of the trader’s continuous growth. To make continuous growth, I trader must have to align with all the latest trading updates. It’s a firm’s duty to facilitate and equip its traders with everything they need to make continuous growth.

So how does a prop firm facilitate a trader in making continuous growth? It could mostly be done by providing 3 major attributes a trader seeks, knowledge or education, tools, and application. So did I find those in The Funded Trader?

Yes, I certainly did.

If you go to their website you’ll find a menu named “Media”. You’ll find all the necessary contents for learning under the Media section. This includes Blogs, Traders Interviews, Community Updates, Community Updates and many more. The Funded Trader blog section is sorted into categories so that you can find your preferred learning contents easily. I liked the blogs and the information they discussed.

The Funded Trader Customer Support

MyForexReport’s definition of best customer support? Who will lead you to a solution promptly and who you may contact at any time, which entails around-the-clock. There is no set time to contact The Funded Trader’s support team; they are available 24/7 in all time zones. This could be a fact that TFT has received so many traders so quickly and this is certainly a strong feature as well.

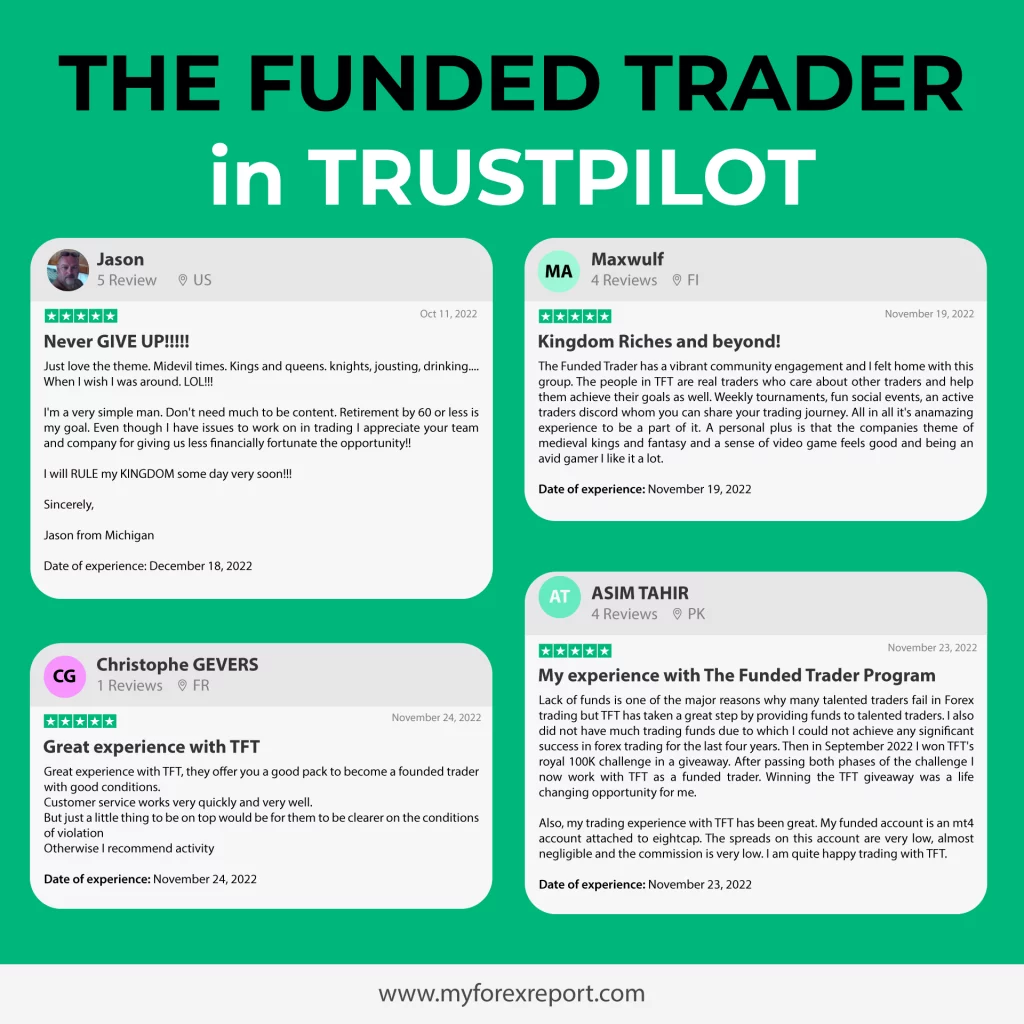

Reputation and The Funded Trader Reviews

Reputation is the mirror of a firm’s legitimacy. If the traders have found a firm good, they’ll definitely talk well about it and share their experience on different platforms. We always believe in

The Funded Trader Trustpilot:

Apart from individual traders, you’ll get the majority of responses from traders about a firm in Trustpilot. Since Trustpilot is a go-to choice to know about a prop firm’s reputation, we find The Funded Trader has a very pristine reputation. This is the rarest scene you’ll find in the industry.

The Funded Trader Alternatives

It’s been quite a few years since The Funded Trader is serving funded accounts to traders. But the market they are offering services is highly competitive so it’s quite vogue to be in trend in such a market. To know the best of The Funded Trader, It would be best to compare them with the others. Let’s look at the stand of The Funded Trader when it gets compared.

The Funded Trader VS E8 Funding:

| Trading Features | The Funded Trader | E8 Funding |

| Phase 1 Profit Target | Standard : 10%Rapid : 8%Royal : 8% | 8% |

| Phase 2 Profit Target | Standard : 5%Rapid : 5%Royal : 5% | 5% |

| Maximum daily loss | Standard : 6%Rapid : 5%Royal : 5% | 5% |

| Maximum Loss | Standard : 12%Rapid : 8%Royal : 10% | 8% |

| Minimum trading days | Standard : 3%Rapid : 0%Royal : 5% | NA |

| Leverage | Up to 200:1 | 1:100 |

| Profit Split | Standard : 80/20 (up to 90/10) Rapid : 80/20 (up to 90/10) Royal : 80/20 (up to 90/10) | Upto 80% |

| Minimum Account Opening Fees | Standard SwingFees:$189Account Size: USD 25,000Standard RegularFees:$189Account Size: USD 25,000 Rapid SwingFees:$299Account Size: USD 50,000Rapid RegularFees:$299Account Size: USD 50,000 Royal ChallengeFees:$289Account Size: USD 50,000 | $228Account Size: USD 25,000 |

| Maximum Account Opening Fees | Standard SwingFees:$1898Account Size: USD 400,000Standard RegularFees:$1898Account Size: USD 400,000 Rapid SwingFees:$899Account Size: USD 200,000Rapid RegularFees:$899Account Size: USD 50,000 Royal ChallengeFees:$1399Account Size: USD 300,000 | $988Account Size: USD 250,000 |

| EA Trading | Partially AllowedDetails:https://tinyurl.com/yey9yfmk | Allowed(at your own risk) |

| News Trading | On Evaluation: AllowedOn Funded Trading: Allowed with Condition | Allowed |

The Funded Trader VS MyForexFunds:

| Trading Features | The Funded Trader | MyForexFunds |

| Phase 1 Profit Target | Standard : 10%Rapid : 8%Royal : 8% | 8% |

| Phase 2 Profit Target | Standard : 5%Rapid : 5%Royal : 5% | 5% |

| Maximum Drawdown/Daily loss | Standard : 6%Rapid : 5%Royal : 5% | 5% |

| Maximum Drawdown/Loss | Standard : 12%Rapid : 8%Royal : 10% | Rapid: 12%Evaluation: 12%Accelerated: No Limits |

| Minimum trading days | Standard : 3%Rapid : 0%Royal : 5% | Rapid: 3 days evaluation: 5 days |

| Leverage | Up to 200:1 | 1:100 |

| Profit Split | Standard: 80/20 (up to 90/10) Rapid : 80/20 (up to 90/10) Royal: 80/20 (up to 90/10) | Upto 85% |

| Minimum Account Opening Fees | Standard Swing Fees:$189Account Size: USD 25,000 Standard RegularFees:$189Account Size: USD 25,000 Rapid Swing Fees:$299Account Size: USD 50,000 Rapid RegularFees:$299Account Size: USD 50,000 Royal Challenge Fees:$289Account Size: USD 50,000 | $49Account Size: USD 5,000 |

| Maximum Account Opening Fees | Standard Swing Fees:$1898Account Size: USD 400,000 Standard Regular Fees:$1898Account Size: USD 400,000 Rapid Swing Fees:$899Account Size: USD 200,000 Rapid RegularFees:$899Account Size: USD 50,000 Royal Challenge Fees:$1399Account Size: USD 300,000 | $979Account Size: USD 200,000 *Scaling opportunity upto $2M |

| EA Trading | Partially AllowedDetails:https://tinyurl.com/yey9yfmk | Allowed(at your own risk) |

| News Trading | On Evaluation: Allowed On Funded Trading: Allowed with Condition | Allowed |

Things That The Funded Trader Should Improve

The Funded Trader does have a countless number of positive attributes but this doesn’t certainly means that they don’t have things to improve. We found a few things they should consider introducing and improving.

First, prop businesses are moving forward to get much closer to their traders through the use of mobile apps. Even the oldest firms, and also Funded Trader’s contemporaries, have started offering their traders apps that are compatible with both Android and iOS.

Is The Funded Trader Funding Legit or a Scam?

In my experience, The Funded Trader showed no signs of deception. They held the necessary licenses, and their actions, such as funding traders and providing them with everything they needed to facilitate forex trading, functioned as proof of their legitimacy. A firm that intends to commit fraud never offers all those things; rather, they focus on finding the simplest ways to commit scams.

The Funded Trader Review Conclusion:

The Forex Prop Trading industry is a blessing for traders who want to scale up. And to scale up you certainly need a firm like The Funded Trader which has been a perfect match, at least for me. You don’t necessarily need to be dramatic to express your emotions and excitement when you get the desired service from a firm you hoped for. So do trade with The Funded Trader and let me know if I could really help you.

Happy Trading! ❤

TFT Frequently Asked Questions

Read the detailed TFT FAQ section updated for 2023.

The Funded Trader does not hold traders’ money or trade for the public or is not a broker. Thus, they don’t need to be regulated. Their ASIC-regulated broker, Eightcap, holds all traders’ funded accounts.

You can debit from credit card/ bank account/ crypto wallet.

They allow Expert Advisors to be used by Royal Accounts only.

You can request your payout by Deel, BTC, ETH, or USDC.

Leave feedback about this