Funded Trading Plus made a name for itself after its creation in 2021. They have been funding traders with a promise of lucrative offerings and profit opportunities. And we thought, “Why not give it a try?”

Hello, Forex traders and enthusiasts! Richard Gibson here, a senior trade analyst at MyForexReport. Since you’ve been eagerly waiting to know about our trading experience and what happened with our funded account with Funded Trading Plus, here we unfold the full story.

As usual, it is important to know about a service provider before using their service. Since it is not that easy to accumulate all the information from different sources, we at MyForexReport make it easy for you to get all the credible and significant information in one place. Now, let’s find out…

Disclaimer: On 3rd September 2024, They again returned MT4 and MT5 platforms provided by the Intertrader broker.

- No Minimum / Maximum time limits

- The process and rules are very straightforward, transparent, and fair

- Enable you to scale up to $2,500,000

- Allow EAs, news trading, and trade copier

- Bi-weekly payout

- They accept crypto

- Do not have consistency rules

- Online Platform Test and Dashboard Tour

- Online Platform Test and Dashboard Tour

- Number one trusted firm on TrustPilot (4.9/5 score)

- Mandatory stop loss and no weekend holding on advance program

- The platform UI/UX is ergonomic and uncluttered

Last Updated on September 11, 2024 by Richard Gibson

The Background of Funded Trading Plus

Funded Trading Plus is a popular name in the forex trading industry. They operate remotely from London, UK. According to the data, they have captured a significant amount of market share in a year through their service, social media presence, and uncompromised client support.

People Behind Funded Trading Plus

Funded Trading Plus has a small team compared to its operation and the services it promises to offer. Simon Massey is the frontman and the CEO of Funded Trading Plus. James Frangleton, the popular guy in the discord channel, is the Director of Operations at FTP, while we found Ryan as the newly recruited marketing manager. You can see all the rest here.

Now that we’ve seen their positive introduction, let’s find out if they were good to us throughout the game.

Funded Trading Plus Legal Information:

| Business Name | FTP LONDON LTD |

| Popular Name | Funded Trading Plus/FT+ |

| UK Tax ID | 413 8673 88 |

| Company Number | 13719292 |

| European VAT Number | EU372045061 |

| CEO | Simon Massey Paul |

| Commenced Operation | 05 November 2021 |

| Organizational Type | Security and commodity contracts dealing activities(66120) |

| Record Type | Secretary of State (SOS) File Number |

| Country | United Kingdom |

| Mailing Address | FTP London, 7 Bell Yard WC2A 2JR London United Kingdom |

Funded Trading Plus General Information:

| 👮 Broker, Liquidity Provider | GooeyTrade (an independent platform provider) |

| 🏢 Headquarters | London, United Kingdom |

| 💲 Minimum Deposit | $119 |

| 💰 Account Currencies | USD |

| 🏦 Funding Models | Experienced (One Phase), Premium (Two-phase), Advanced (Two Phase), Master (Instant) |

| 💸 Scale-Up Plan | Up to $2,500,000 |

| 💻 Trading Platforms | MT4, MT5, Match-Trader, DXtrade, CTrader |

| 🛠 Instruments | Forex, Metals, Energies, Cryptos, Equities, Indices, Shares / ETFs and Futures |

| ⚖ Leverage | Forex pairs/commodities – 1:30 Indices – 1:20 Crypto – 1:2 |

| 🥂 Profit Share | Initially 80% and can be moved up to 100% with 30% profit gain |

| 🎮 Free Trial | Not Available |

| 📲 Mobile App | Not Available |

| ☎ Support | 24/7 Instant Support |

| ✂ Discount Code | Get 20% OFF |

What are the types of Funded Trading Plus accounts? How costly are they?

Funded Trading Plus has 4 types of account offerings. They are titled Experienced Trader Program, Premium Trader Program, Advanced Trader Program, and Master Trader Program.

So, what did we get according to their account offering? Well, we got their Experienced trader program with a funding option of $50,000. This evaluation is conducted in a single phase; our goal is to reach the point where the profit split begins at 80/20, with the possibility of reaching 90/10 under certain conditions.

There is no minimum trading day pressure, but we must achieve a total profit of 10%, while defending against a 6% relative drawdown and a 3% daily drawdown. I have been trading in this account for a while and received a significant profit return. To learn more about my payout, please scroll down to the payout proof section.

Experienced Trader Program (One-Phase)

| Evaluation Type | Single Phase |

| Profit Split | 80/20 ( up to 90/10) |

| Profit Target | 10% |

| Min. Simulated Trading Days | None |

| Maximum Simulated Leverage | Up to 1:30 |

| Platforms | DXTrade MatchTrader cTrader (not available for US clients) MT4, MT5 ( Not available for US Traders) |

| Max Simulated Drawdown | 6% |

| Max Simulated Daily Drawdown | 4% |

| Account Size (USD) | $12,500 | $25,000 | $50,000 | $100,000 | $200,000 |

| Refundable Fee | $119 | $199 | $349 | $499 | $949 |

Advanced Trader Program (Two Phase)

Advanced Trader’s account is made for more advanced traders who want to challenge themselves. In Phase 1 you have, march for 10% profit and in Phase 2 for 5%. The profit split, relative drawdown, and daily drawdown are still the same. I think most traders would appreciate that there are no limitations. Obviously, Funded Trading will want everyone to complete the phases as soon as possible, but you won’t really encounter any real pressure to do that. After we get our desired profit in the Experienced Trader program I plan to get an Advanced account. We will let you know how that goes.

| Evaluation Type | Two Phase |

| Profit Split | 80/20 (up to 90/10) ( After getting the funded account) |

| Phase 1 Target | 10% |

| Phase 2 Target | 5% |

| Min. Simulated Trading Days | None |

| Maximum Simulated Leverage | Up to 1:30 |

| Platform | DXTrade MatchTrader cTrader (not available for US clients) MT4, MT5 ( Not available for US Traders) |

| Max Simulated Drawdown | 10% |

| Max Simulated Daily Drawdown | 5% |

| Account Size (USD) | $25,000 | $50,000 | $100,000 | $200,000 |

| Refundable Fee | $199 | $349 | $499 | $949 |

Premium Trader Program (Two Phase)

Funded Trading Plus has recently launched another two-phased program. I personally talked to them about it and they told me that traders often contacted them about bringing some changes and additions to the advance program. The FT+ team complied with all these suggestions and developed a new program.

I think moves like these showcase how a firm caters to its customer’s needs. We will trade in this program in the future. For now, I am just gonna share my findings with you.

The rules of this trading program are a bit relaxed here compared to the advanced program. Here, in the first phase of the evaluation, you have to get 8 percent profit with the challenge of maintaining below 4% daily and 8 % total drawdown. In the second phase, you need to get a profit of 5 %. Here, the daily and total stimulated drawdown is the same as in Phase 1. In the table, you will find a detailed analysis of the program:

| Evaluation Type | Two-Phase |

| Profit Split | 80/20 (up to 90/10) ( After getting the funded account) |

| Phase 1 Target | 8% |

| Phase 2 Target | 5% |

| Min. Simulated Trading Days | None |

| Maximum Simulated Leverage | Up to 1:30 |

| Platform | DXTrade MatchTrader cTrader (not available for US clients) MT4, MT5 ( Not available for US Traders) |

| Max Simulated Drawdown | 8% |

| Max Simulated Daily Drawdown | 4% |

| Account Size (USD) | $25,000 | $50,000 | $100,000 | $200,000 |

| Refundable Fee | $247 | $397 | $547 | $1097 |

Master Trader Program

Our other in-house trader, Cody, did a bit of Trading on this program. Funded Trading Plus doesn’t ask for competency tests in their Master Trader Programme. We got an instant funded account as soon as we paid the fees. We paid for a mid-tier account, a $25K account with a $1125 fee. This is expensive. But they won’t just hand you a funded program without some compensation, right?

The most interesting thing about this program is that there is no profit target. You have free access to your trades. We just had to make sure that we didn’t get below the daily and total stimulated loss target.

| Evaluation Type | Instant Funded (No Evaluation) |

| Profit Split | 80/20 (up to 90/10) |

| Profit Target | No profit target |

| Min. Simulated Trading Days | None |

| Maximum Simulated Leverage | Up to 1:30 |

| Platform | DXTrade MatchTrader cTrader (not available for US clients) MT4, MT5 ( Not available for US Traders) |

| Max Simulated Drawdown | 6% |

| Max Simulated Daily Drawdown | 6% |

| Refund | No refunds |

| Account Size (USD) | $5,000 | $10,000 | $25,000 | $50,000 | $100,000 |

| One Time Fee | $225.00 | $450.00 | $1,125.00 | $2,250.00 | $4,500.00 |

FTP Funding Evaluation Phases

| Maximum Trading Day | Funded Trading Plus doesn’t have any maximum or minimum trading day restrictions. They are open to trade until you breach any of their stated trading rules. |

| Maximum Daily Loss | With Funded Trading Plus, you are not allowed to lose more than 3%, 4%, or 5% per day in the Experienced Trader, Premium Trader, and Advanced Trader account plans, respectively. |

| Maximum Loss | You won’t be allowed to lose more than 10% of your account size in the Experienced and Advanced Program. So, In the case where you have 100K invested, you will not be allowed to lose more than 10K. In the Premium Trader Program, the maximum you can lose is 8%. |

| Profit Target | In Phases 1 and 2, the profit target in Funded Trading Plus Experienced and Advance accounts is set to 10% ( Phasr-1) and 5% (phase-2) of your account. In the Premium Trader Program, it is set to 8% ( phase-1) and 5% (phase-2). |

| Copy Trading | Social Trading/copy trading is not directly discouraged by Funded Trading Plus since their partner brokers support it. So it is actually okay to use Copy/Social Trading. We highly recommend you avoid engaging in any social trading without proper legitimacy and results. We highly recommend you avoid engaging in any social trading without proper legitimacy and results. |

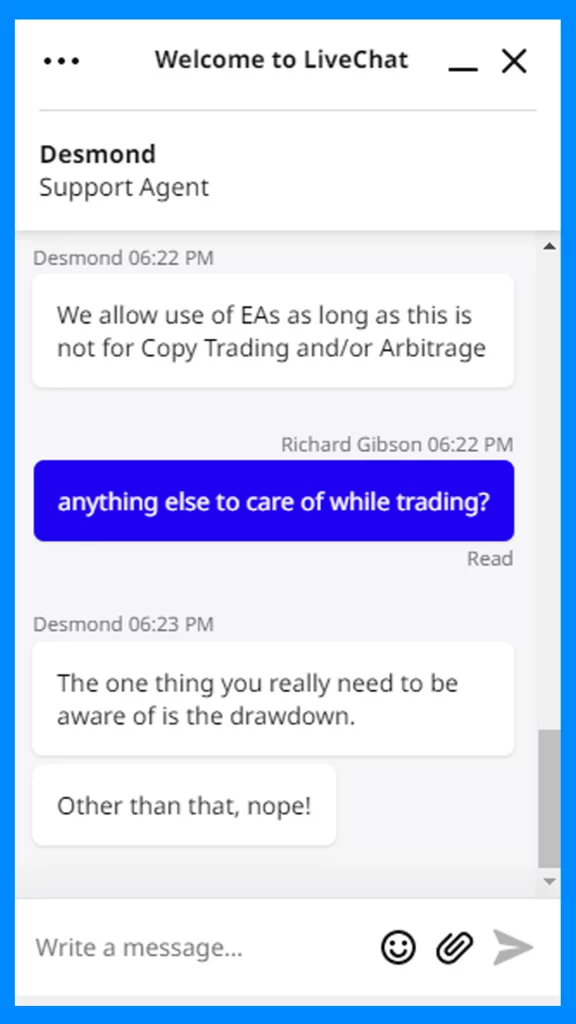

| Trading on Expert Advisor | Funded Trading Plus has no restrictions on any EAs. So you know what you can do with it 😉 |

Funded Trading Plus Spreads

Funded Trading Plus doesn’t have a different spread count. Their spreads are the same as those of their partner broker, GooeyTrade Spread.

Funded Trading Plus Dashboard Tour (Real Account )

Like I said before, we got the $50,000 Experienced Trader Account from them for a $349 fee. I got the MT5 platform. I checked out their new platforms, too. So far, everything seems good.

Funded Trading Plus has worked on its dashboard management. What I like most about it is that I can clearly see the overview of my trades in the dashboard. They mention all the rules, regulations, and definitions for the traders to see here. However, I think they need to work on it more. Over the years, I have traded in many top prop firms; compared to that, their dashboard needs to improve. Their dashboard needs more traders-friendly tools like a pip calculator, economic calendar, etc. I hope they work on these aspects.

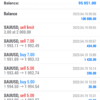

Payment Proof and Profit Split

If you are revisiting, then you would know that we promised to show our payment proof. So, here it is. When we got profit and asked for a payout, they first gave us a payment form. We put the information there, and within 24 hours, they sent me my profit split in a crypto account through Triple-A. After that, they even emailed us an invoice for our payout.

Note that they have two payout methods: bank transfer and crypto. You can use any one of those.

Apart from that, We have talked to many traders in the community and asked for their genuine reviews. All of them showed us their legit bi-weekly payouts. They even have a dedicated section in their Discord server where traders showcase their payouts. I am going to leave some of those proofs here for you to see:

FTP Education, Tools, and Application

A trader-friendly Forex Prop Firm not only limits itself to funding traders but also closely monitors the growth of its funded traders and offers them more opportunities to profit. There are many ways to offer these extra services, but most of them are meant to teach traders all the tips and tricks they can find about forex trading.

Funded Trading Plus provides insightful and informative material. These articles are posted on their website under “Blogs,” but these helpful resources for traders aren’t always posted. We expected that they would be equipped with all the necessary devices and tools, like the Pip Calculator, Lot Size Calculator, Currency Converter, Economic Calendar, and other features that would aid traders in making judgments. We didn’t find any of them, as we feared.

Trading Assets and Instruments

You can find a list of all available instruments here.

Commission

Forex: When trading Forex, you are charged a commission of $3.50 per standard lot traded. A standard lot typically equals 100,000 units of the base currency. The $3.50 commission is charged per trade, so when you open a trade, you pay $3.50; when you close the trade, you pay another $3.50. This totals $7.00 for the complete trading cycle, known as a “round trip.”

Commodities, indices, and cryptocurrencies: no commission is charged on your trades. Instead of a commission, the cost of trading these assets is built into the spread. The spread is the difference between the buy (ask) and sell (bid) prices. This means you pay slightly more to buy an asset than you would get if you sold it simultaneously, and this difference represents the broker’s fee.

Additional Concern

Refund Policy

Experienced, Advanced, and Premium Traders are eligible for fee refunds after achieving a 10% profit on their simulated live trading. This means you will not just get your fee after passing the evaluation. After getting through the evaluation, you will get their funded account. And once you get 10% profit in their funded account, you will get your fee back.

Weekend Holding

- Experienced and Premium Trader Programs: You can keep your trades open over the weekend. This means that if you have ongoing trades by the end of the trading week (typically Friday evening), you do not need to close them, and they can remain active until the markets reopen after the weekend.

- Advanced and Master Trader Programs: You must close all your trades by Friday evening. This means you cannot leave any positions open over the weekend, possibly to avoid the risks associated with market movements when markets are closed.

News Trading

You are allowed to trade during news events at any time, including over the weekend if applicable to your program. However, you shouldn’t risk your entire account or a large portion of it on a single news trade. This is because news events can cause significant volatility, and trading with too much of your account balance could lead to large losses.

Reputation and Funded Trading Plus Reviews

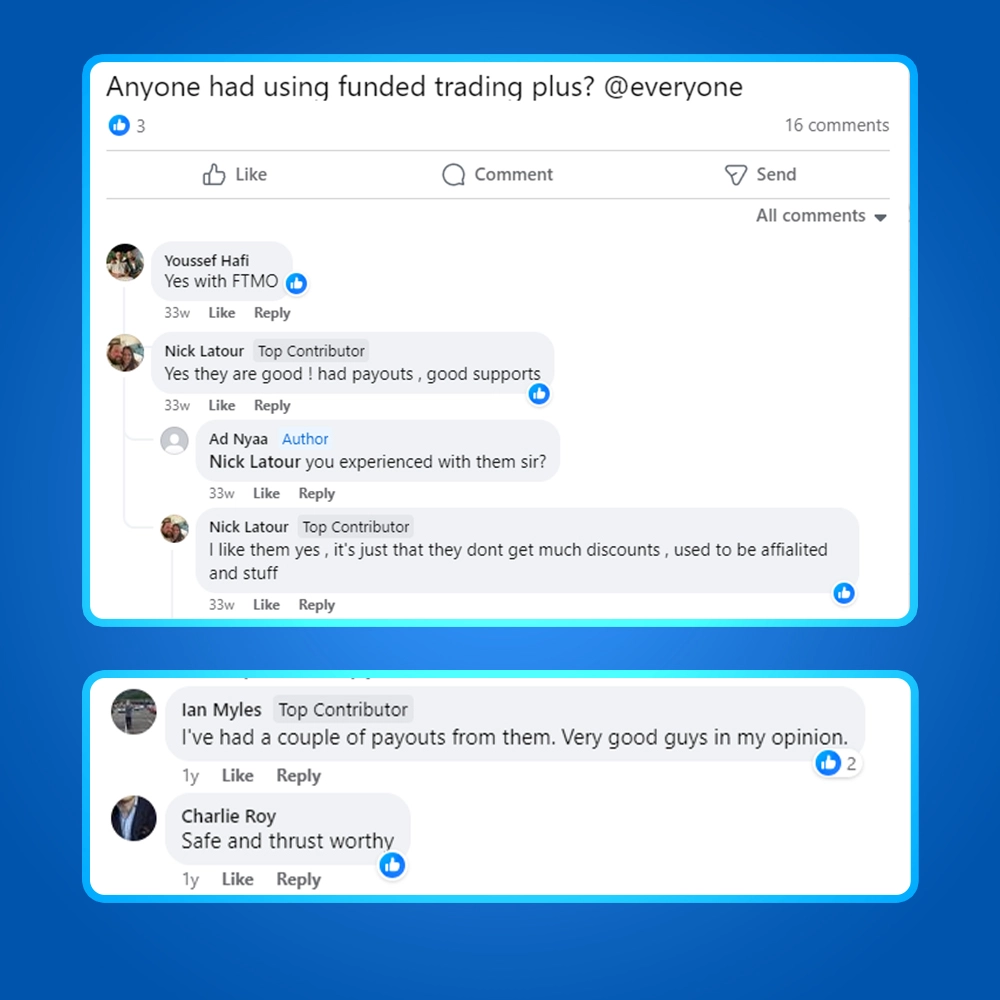

In any competitive market, reputation plays one of the most significant roles in grabbing a significant portion of market acquisition. However, we at MyForexReport always seek fairness in commenting, so we reach out to other traders to know their experience. Nonetheless, we were somewhat satisfied with their reputation in the traders community, and to be honest that’s the reason we chose to trade with them. Even in FundedTrading Plus’s case, we went our way and communicated with a few other traders to know their verdict.

Funded Trading Plus Experience:

As you know, we’ve chatted with many FTP traders. We wanted to know about their experience as well. We researched the trader community on Facebook, Linked, and Twitter and found that traders are highly satisfied with FTP’s services.

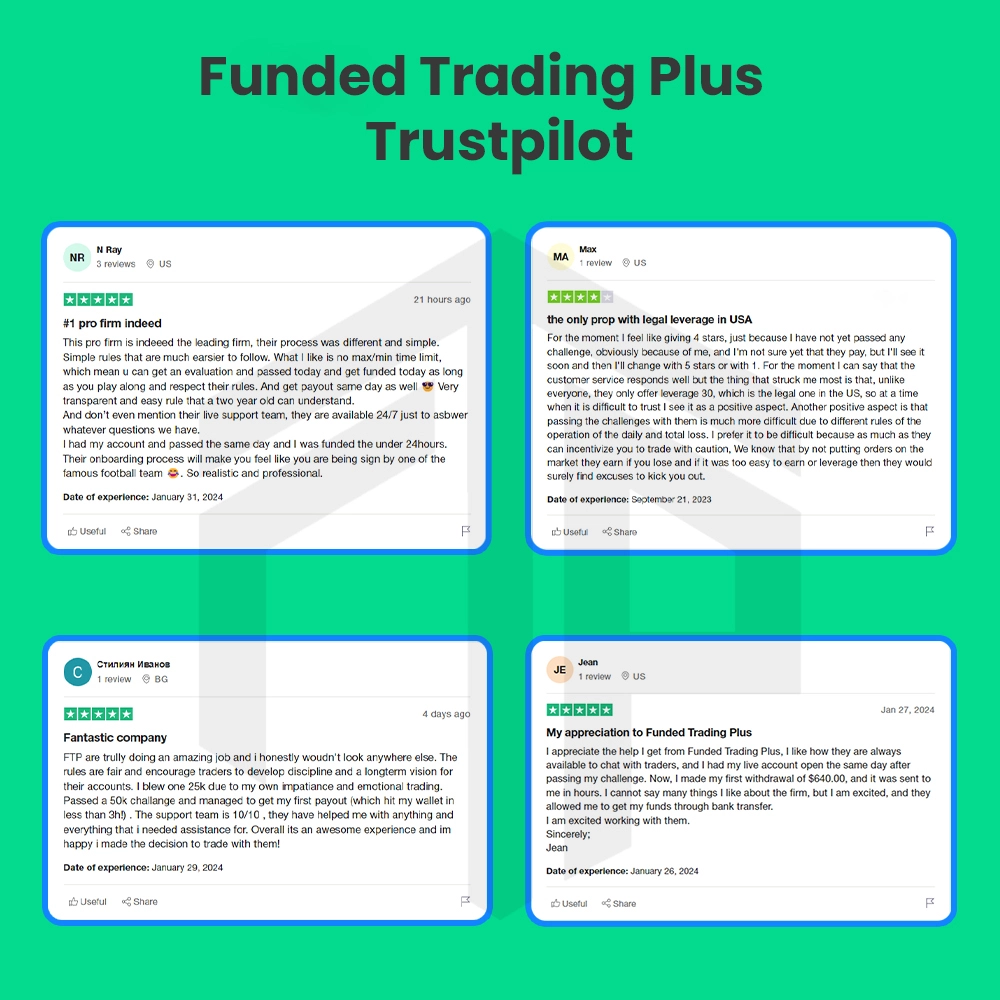

Funded Trading Plus Trustpilot:

In Trustpilot, FTP Funding has got quite the hit. Most traders gave it a 5-star. The honest reviews help it climb the ladder of ranking. Now, FTP funding ranks as the number one firm on Trustpilot.

Funded Trading Plus Customer Support

How do we define effective customer support? Obviously, the one you can reach at any hour, that means 24/7.FTP does not have a specific time for contacting its support staff; they are open at any time in any time zone. It is a strong strength of FTP to have so many trader acquisitions so quickly.

Funded Trading Plus Alternatives

Funded Trading Plus has been in this fiercely competitive market for almost three years. They are a force to be reckoned with now. But in the market, they still have firms competing with them. In the section below, we’ve tried to compare Funded Trading Plus and their best alternatives. FTMO and E8, to date, are the two most popular Forex prop firms.

Funded Trading Plus VS FTMO:

| Trading Features | Funded Trading Plus | FTMO |

| Phase 1 Profit Target | Experienced Trader(Single Phase) : 10% Advanced Trader: 10% Premium Trader: 8% *Master Trader does not require any Profit Target | 10% Profit Target |

| Phase 2 Profit Target | Premium Trader: 5% Advanced Trader: 5% | 5% Profit Target |

| Maximum Daily Loss | Experienced Trader: 4% Advanced Trader: 5% Premium Trader: 4% Master Trader: 6% | 5% |

| Maximum Loss | Experienced Trader: 6% Advanced Trader: 10% Premium Trader: 8% Master Trader: 6% | 10% |

| Minimum Trading Days | NA | 4 |

| Leverage | Up to 1:30 | 1:100 & 1:30 (FTMO Swing) |

| Profit Split | Experienced Trader: 80/20 (up to 90/10, 100/0) Advanced Trader: 80/20 (up to 90/10, 100/0) Premium Trader: 80/20 (up to 90/10, 100/0) Master Trader: 80/20 (up to 90/10, 100/0) | Up to 90% |

| Minimum Account Opening Fees | $119 Account Size: USD 12,500 | €155 Account Size: $10,000 |

| Maximum Account Opening Fees | $4,500 Account Size: USD 100,000 | €1,080 Account Size: $200,000 |

| EA Trading | Hedging, Allowed(at your own risk) | Allowed(at your own risk) |

| News Trading | Allowed | Allowed |

Funded Trading Plus VS E8 Markets:

| Trading Features | Funded Trading Plus | E8 Markets |

| Phase 1 Profit Target | Experienced Trader(Single Phase) : 10% Advanced Trader: 10% Premium Trader: 8% *Master Trader does not require any Profit Target | 8% Profit Target |

| Phase 2 Profit Target | Premium Trader: 5% Advanced Trader: 5% | 4% Profit Target |

| Maximum Daily Loss | Experienced Trader: 4% Advanced Trader: 5% Premium Trader: 4% Master Trader: 6% | 4% |

| Maximum Loss | Experienced Trader: 6% Advanced Trader: 10% Premium Trader: 8% Master Trader: 6% | 8% |

| Minimum Trading Days | NA | 1 |

| Leverage | Up to 1:30 | 1:100 |

| Profit Split | Experienced Trader: 80/20 (up to 90/10, 100/0) Advanced Trader: 80/20 (up to 90/10, 100/0) Premium Trader: 80/20 (up to 90/10, 100/0) Master Trader: 80/20 (up to 90/10, 100/0) | Up to 80% |

| Minimum Account Opening Fees | $119 Account Size: USD 12,500 | $59 Account Size: USD 5,000 |

| Maximum Account Opening Fees | $4,500 Account Size: USD 100,000 | $988 Account Size: USD 200,000 |

| EA Trading | Hedging, Allowed(at your own risk) | Allowed(at your own risk) |

| News Trading | Allowed | Allowed |

Things That Funded Trading Plus Should Improve

If you’ve read this far, you might have already noticed that we’ve tried to do proper justice to Funded Trading Plus’ services and offerings according to our experiences. This is our sole duty as an independent trader’s investment advisory or consulting firm to find the for and against of the prop firms as well.

1. Trader’s Dashboard

Funded Trading Plus has a lot of work to do on their dashboard. They give a detailed overview of their trading but still need to incorporate trader-friendly tools in their system.

2. Website UI/UX

Although UI & UX may not be considered a significant concern for a trader, this is only sometimes the case. We traders are looking for a quick and informative site experience where we don’t have to click and scroll through too many things to find the information. In this case, Funded Trading Plus is falling behind. Our suggestion to them would be to improve their user interface so that we don’t have to jump through too many hoops. I believe they have received or will receive feedback similar to mine in this regard.

Is Funded Trading Plus Funding Legit or Scam?

According to our experience, we cannot in any way label them a fraud, never. A legitimate prop firm typically fulfills specific criteria, such as maintaining a physical office, a Meet the Team page, evidence of the CEO’s activities, trader profit proof, and more. FTP has a physical office in London, and the CEO actively engages with the community through various social media. Apart from that, I have found legal documents to support their claim. Considering these factors, I can easily say that Funded Trading Plus is legit.

Funded Trading Plus Review Conclusion:

Without being dramatic or diplomatic, I would say that I am completely satisfied with Funded Trading Plus. Their funding programs, services, and overall performance over the year mark their dedication to the community. Throughout my review, I have been honest and tried to give my honest review and recommendations. If any of my/our comments help them improve in any way, I would be glad on behalf of my team, MyForexReport.

Happy Trading! ❤

Frequently Asked Questions (FAQ)

Read the detailed FTP FAQ section updated for 2024.

Actually, proprietary trading firms do not hold trader money or trade for the public or are not brokers. Thus, they don’t need to be regulated. Their ASIC-regulated broker, Eightcap, holds all their traders’ funded accounts. However, Funded Trading Plus is a brand of FTP London Ltd that is registered in England, United Kingdom.

Their registered company address is 7 Bell Yard, London, WC2A 2JR.

Company Number: 13719292

UK VAT Number: 413 8673 88

European VAT Number: EU372045061

ThinkMarkets

No. They don’t have trial or demo option. They do have a Demo account to test your Trading Style however this does not count towards anything – https://www.fundedtradingplus.com/platform-demo/

Firstly, select the program & account size you wish to purchase. You can then choose the trading platform that best suits you, either ThinkMarket’s MT4/MT5 platform. Then, follow the steps with your details like name, country, address, email, and payment methods to complete the purchase process.

They accept credit cards, debit cards, and cryptocurrencies.

Fees for the Experienced Trader, Premium Trader, and Advanced Trader Programs are refundable once traders reach their first profit target.

Note: Fees are not refundable on the Master Trader Program.

Step 1: Go to your account dashboard and select the withdrawal request button. Make sure to close all trades before making a withdrawal request, and do not start trading again until profit has been withdrawn, hopefully within 48 hours.

Step 2: You will receive an invoice request from info@fundedtradingplus.com and complete your invoice.

Currently, they offer withdrawals via cryptocurrency and bank transfers.

Yes, Funded Trading Plus allows EA, algorithms, and bots. When selecting strategies and EAs, remember the rules and limits.

Yes, you can trade during news events.

Leave feedback about this