MyForexFunds is a Canada-based Forex Proprietary Trading firm that has been running their business remotely for quite a long time. They are among the first few names you may remember when you hear about forex proprietary firms. With the second largest market capitalization according to reports, MyForexFunds has been just close to their competitor to be the market leader.

Hello my dear Forex traders! This is Marco Di Chiara, the MyForexReport trader and senior trade analyst. Today I’ll be sharing how my trading journey has been with MyForexFunds. In this write-up you’ll find how my evaluation phases have been, how the funded trading phase was and all the ins and outs of trading with MyForexFunds. I hope my experience will help you decide whether you should trade with a MFF funded account.

Before we invest in any service, we always conduct a background check, as that is the best way to ensure our investment is safe. Let’s find out the background of MyForexFunds.

- 112% refund with first payout on the live account.

- Instant Funding

- Up to 85% profit share

- Favourable spreads and commission

- Hedging, EA's, copiers, and risk management tools are allowed

- Traders can trade during news events

- Trials and demos are not available

- Slippage Issues

- support is slow due to the waiting queue

Last Updated on July 6, 2024 by Richard Gibson

MFF is currently unavailable. We will update our review when they are back online.

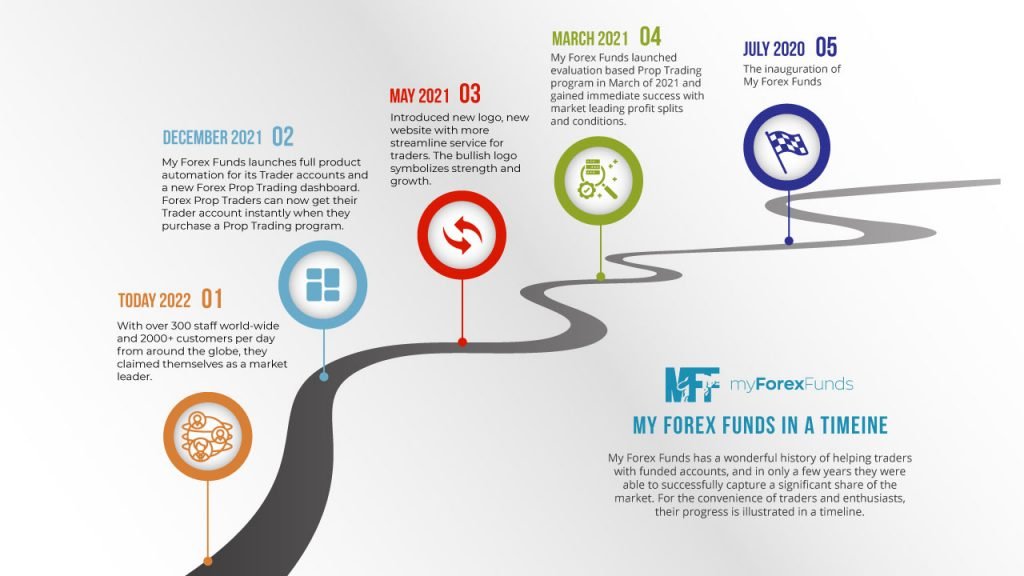

The Background of MyForexFunds

MyForexFunds is a company based in the busiest financial hub, in the heart of Toronto, Ontario, Canada. They started their operation at the time of Corona, July 2020. They run by the motto “Your Success is Our Business”, which is probably a clear picture of how they feel about the success of a trader. Since they are based in the same country as we are, we can be bold about the claims we can make about them. We’ve compiled all their legal information in the following section. In later sections, I’ve explained my thorough experience trading with MyForexFunds’ money.

MyForexFunds Legal Information:

| Business Name | Traders Global Group Incorporated |

| Company ID | 12646170 |

| CEO | Murtuza Kazmi |

| Commenced Operation | July 2020 |

| Company Type | Corporation |

| Incorporation Date | 13 January 2021 |

| Record Type | Secretary of State (SOS) File Number |

| State of Formation | ON |

| Jurisdiction | Canada |

| Governing Legislation | Canada Business Corporations Act – 2021-01-13 |

| Mailing Address | 9131 Keele Street, Vaughan, Ontario, ON L4K 2N, Canada |

Now that you get to know about the regulations and other background staffs of myforexfunds, let me walk you through the offered MFF Accounts.

MyForexFunds General Information:

| 👮 Broker, Liquidity Provider | Traders Global Group |

| 💲 Minimum Deposit | $49 |

| 💰 Account Currencies | USD |

| 🏦 Funding Models | Rapid, Evaluation, Accelerated |

| 💸 Scale Up Plan | Up to $2M |

| 💻 Trading Platforms | MT4, MT5 |

| 🛠 Instruments | Forex, metals, CFDs and Cryptocurrency |

| ⚖ Leverage | 1:100-1:500 |

| 🥂 Profit Share | Up 85% |

| 🎮 Free Trial | Not Available |

| 📲 Mobile App | Not Available |

| ☎ Support | 24/5 |

| 🔥 Coupons | Get 5% OFF |

My Forex Funds Accounts and Pricing

According to my experience, My Forex Funds offered 3 types of accounts which they call programs. The programs are Rapid, Evaluation, and Accelerated. In the following sections we tried to elaborate on these programs and our experience with those programs.

MFF Rapid Program:

I’ve been trading the MFF Rapid program since the first week of August. Though they have four different funding plans for this program, I bought the $50,000 funded account for a refundable fee of $399. I feel this refundable fee offering is something new to many forex traders.

However, I found something really cool here in Rapid Program, you can treat it like a demo or trial account. Why? There is no profit target to achieve and you even get 12% of the profit you make here. After the first month, my net balance was $73,715 since I made a profit of $23,715. I was later given 12% of the $2,846 profit. There is a catch!

To get this 12%, I had to follow some strict rules which every trader might be disturbed to follow. I had to follow rules such as minimum trading days, daily starting drawdown, overall drawdown, frequency, and consistency. This may sound hard, but I was able to trade well when I had a risk management plan in place from the start. It was like when the pilot and first officer of an airplane do a thorough safety check and pre-flight checklist in the cockpit.

To make these Rapid Program rules simpler for you, I’ve listed the rules in a descriptive manner below.

| Evaluation Type | 90 Days Trading Evaluation |

| Profit Split | 12% for first 3 Months 50% on 4th months 65% on 5th months 80% on 6th months and onwards |

| Profit Target | No profit Target |

| Min. Trading Days | 3 days a week |

| Maximum Leverage | 1:500 for Forex, metals and CFD 1:5 for Crypto |

| Platforms | MT4, MT5 |

| Overall Drawdown | $1,200 for $10,000 Account $2,400 for $20,000 Account $6,000 for $50,000 Account $12,000 for $100,000 Account |

| Daily Drawdown | $500 for $10,000 Account $1,000 for $20,000 Account $2,500 for $50,000 Account $5,000 for $100,000 Account |

| Account Size (USD) | $10,000 | $20,000 | $50,000 | $100,000 |

| Refundable Fee | $99 | $189 | $399 | $749 |

The noticeable thing here is that you can’t scale your MFF Rapid Program Account.

MFF Evaluation Program:

We didn’t trade the evaluation program of myforexfunds, but we researched the program before choosing which program to trade. You could be thinking right now that we skipped the Trading Evaluation Program since trading might be challenging. This is not the case; instead, we make decisions that are in the trader’s best interests. Read out the findings from our research on the My Forex Funds Evaluation Program Account type.

So, the My Forex Funds Evaluation Program is a funding program with two phases of evaluation. In the first phase you’ll have to hit an 8% profit target, trading 5 days a week, your maximum daily loss can never be more than 5% and the total daily loss has to be within 12 percent. The 8% profit target must be met within 30 days after the first trade placing. If you can meet these conditions then you’re good to reach the second step.

In the second phase, you’re given 60 days to meet their requirements to get a fully funded account. Here, your profit target is 8% and you must achieve it within the first 30 days of placing your first trade. The same drawdown rules that we stated in the earlier evaluation phase apply in this phase as well, which means that the maximum daily loss can never exceed 5% and the total daily loss must not exceed 12%. If you can meet this requirement, you’ll be funded with a real funded account. However, upon completion of phase two, you’ll get 2% of the profit you made in the first phase.

Your MFF evaluation program account will be funded once you have met all the requirements. In this program account, you will defend a maximum drawdown of 12% here and 5% every day. The initial payout will be distributed within 30 days of the first trade being executed on a funded account. However, here you must trade for 10 days to be eligible for the payout. You will receive an additional 4% of your evaluation phase profit along with 75% of the profits you achieved with the funded account on your first payout. The adventure of trading this program is not over yet! Your initial deposit will be refunded to you at a rate of 112%. Your profit shares will be scaled to 80% for the next two months and then be increased to 85% starting the third month after you receive your first reward.

You can find everything you need to know about an Evaluation Program account from the list below.

| Evaluation Type | Two Phase Evaluation(30 days+60 days) |

| Profit Split | Phase 1= 2% Phase 2= 4% Live Month 1 = 75% Live Month 2 = 80% Live Month 3+ = 85% |

| Profit Target | Target for Phase 1 is 8% Target for Phase 2 is 5% For Phase 3 (Live account), there is no profit target |

| Min. Trading Days | Each phase is 5 trading days |

| Maximum Leverage | 1:100 for Forex, metals and CFD’s 1:5 for Crypto. |

| Platforms | MT4, MT5 |

| Daily Drawdown | 5% $250 for $5,000 Account $500 for $10,000 Account $1000for $20,000 Account $2500 for $50,000 Account $5000 for $100,000 Account $10,000 for $200,000 Account |

| Overall Drawdown | 12% $600 for $5,000 Account $1,200 for $10,000 Account $2,400for $20,000 Account $6,000 for $50,000 Account $12,000 for $100,000 Account $24,000 for $200,000 Account |

| Account Size (USD) | $5,000 | $10,000 | $20,000 | $50,000 | $100,000 | $200,000 |

| Fees(USD) | $49 | $84 | $139 | $299 | $499 | $979 |

MFF Accelerated Program:

The Accelerated Program Account is the third type of account that My Forex Funds offers. This account type has two variants: conventional and emphatic. In the Accelerated Program we didn’t find any rules like maximum daily loss, time limitations, lot size restrictions and rules to be consistent with trade. Since you won’t have to stick to restrictions or rules, I think traders like me were eager to trade this account because there would be less stress involved. Another substantial release of tension comes from the nonexistent profit target meeting goal.

Conventional Accelerated Program Account

| Evaluation Type | No evaluation required |

| Profit Split | 50% |

| Profit Target | No Profit Target or achieve 10% to Scale up your account |

| Min. Trading Days | NA |

| Maximum Leverage | 1:50 for Forex, metals and CFD’s 1:5 for Crypto |

| Platforms | MT4, MT5 |

| Daily Drawdown | NA |

| Overall Drawdown | 5% from the Starting balance |

| Account Size (USD) | $2,000 | $5,000 | $10,000 | $20,000 | $50,000 |

| Fees (USD) | $99 | $245 | $485 | $970 | $2,450 |

In addition, you have the option to scale your account up to 1350K in the Conventional Accelerated Program. You can scale your account in different phases since this scaling plan is dependent on the size of your account. The only reason you need to scale up your account is to meet your 10% profit target. At every payout moment, there is an option to scale up. You might be worried about withdrawing and wondering if you’re still eligible to scale your account. To put your mind at ease, the answer is yes if you hit the 10% profit target prior to the withdrawal.

Emphatic Accelerated Program Account:

| Evaluation Type | No evaluation required |

| Profit Split | 50% |

| Profit Target | 20% |

| Min. Trading Days | NA |

| Maximum Leverage | 1:100 for Forex, metals and CFDs 1:5 for Crypto |

| Platforms | MT4, MT5 |

| Daily Drawdown | NA |

| Overall Drawdown | 10% from the Starting balance |

| Account Size (USD) | $2,000 | $5,000 | $10,000 | $20,000 | $50,000 |

| Fees (USD) | $198 | $490 | $970 | $1,940 | $4,900 |

Like the one in the Conventional Accelerated Program, in the Emphatic Program you also get the flexibility to enter direct trading by bypassing the evaluation stage. With a leverage of 1:100 and an account scaling opportunity of up to $2,020,000, the profit split can be as high as 50%. In Emphatic, you must meet a 20% profit target to be eligible to scale up your account. Do not forget that you can neither use an EA nor use weekend holdings.

| Copy Trading | My Forex Funds allow copy Trading. |

| Trading on Expert Advisor | – Traders are allowed to trade with any indicator they like: Discretionary trading, hedging, algorithmic trading, and Expert Advisors; you may choose to use anything you like according to your strategy. – Not Allowed in the Emphatic Accelerated Program. However, we, the MyForexReport team of traders, discourage you from having a high-frequency EA. |

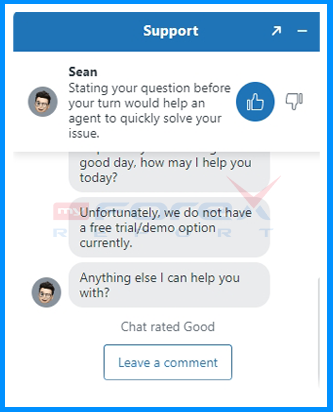

My Forex Funds Trial or Demo Account Offerings

We, professional traders, who are always into trading face different trading situations and scenarios. Having years of experience in the field, we somehow manage to survive based on our expertise and experience. But consider this for a newbie in trading, when they fall into such situations with their investment they suffer terribly. To manage such kinds of events, demo and trial accounts are provided by the prop firms. Sadly to say, we didn’t find My Forex Funds to offer any trial or demo account anywhere on their website. So we contacted their support to know about it, basically to confirm what we were anticipating. Without any further surprise, they confirmed that they do not provide any trial or demo account.

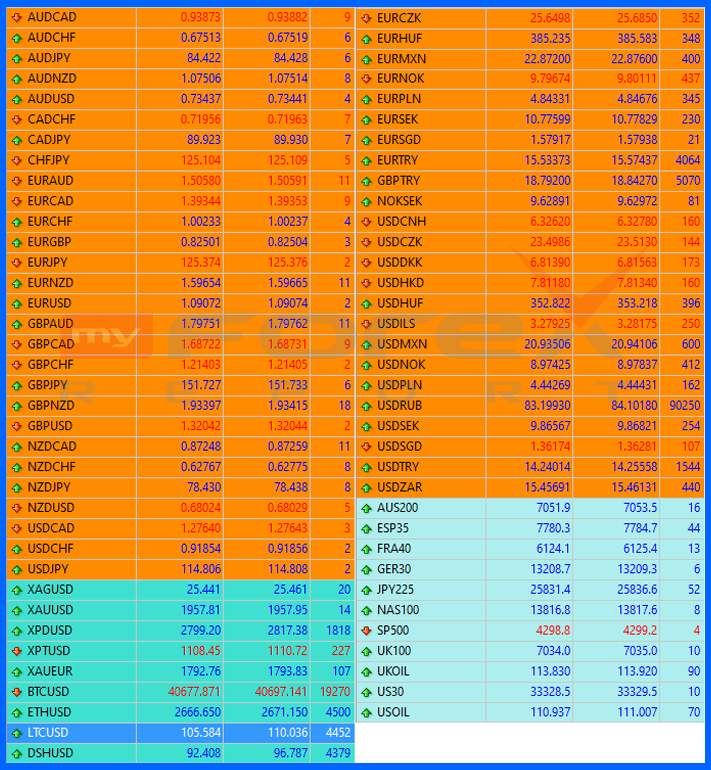

My Forex Funds Spreads

MyForexFunds have a raw spread like the one we had with E8 Funding. The spread differs from instrument to instrument and asset to asset. For a better understanding, I’ve attached the spread count list below.

In our experience, My Forex Funds offers the tightest spreads for any instrument. You may hardly find any major and minor forex currency pair exceeding 10 pips of spread. We may not guarantee you about the other assets and trading instruments since we didn’t trade those but you can see the spread count from the chart above. It is still tighter in that aspect too.

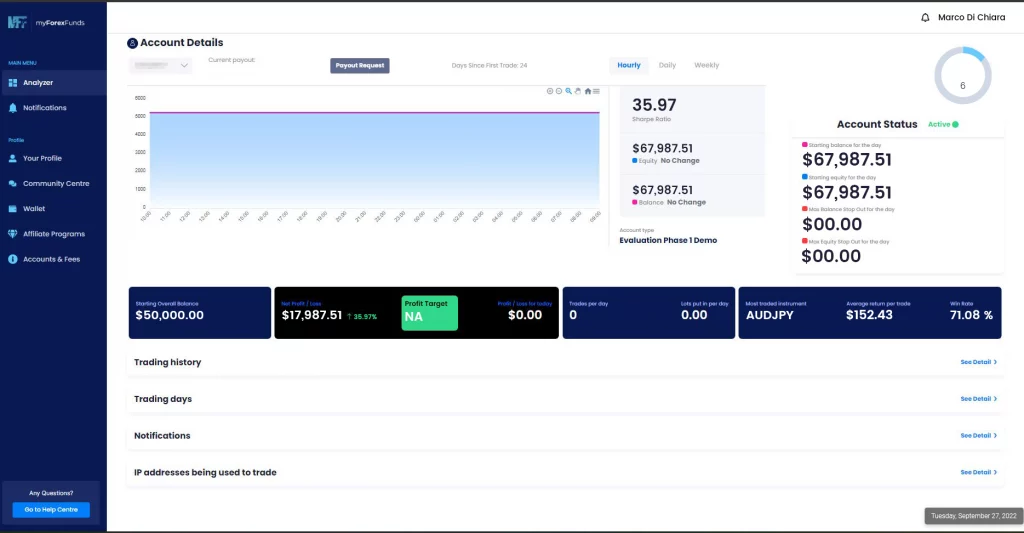

MyForexFunds Dashboard Tour (Real Account ):

MyForexFunds doesn’t offer a demo dashboard tour. So we thought of guiding you with our MFF real trading account. Hopefully, you will be able to gain a better understanding of what MyForexFunds offers in their dashboard and our credibility regarding the statements and claims.

However, according to my experience operating this dashboard, I can firmly say that the dashboard is just flawless. It is well designed with all the necessary gadgets and information put in place. I get real-time data of funds and trades. As well as the trading history, the days I traded, and the remaining evaluation days are also shown in the dashboard.

If I were to describe the MFF dashboard in one sentence, it would be “makes trading easier and more efficient”.

Payment Proof and Profit Split

In addition to the above dashboard, we need to provide further proof of a legitimate payout and the evaluation certificate from MyForexFunds. Since I traded the Rapid Program, here I added the payout I received to their promised 12%. The payout I received was $2,846 and they sent it to my Deal Account upon confirmation. Besides, I received a certificate for passing the evaluation phase.

MyForexFunds Education, Tools, and Application

Every forex trading service provider now takes the education of traders seriously and MyForexFunds is no different. Under their blog sections, they provide a frequently updated educational blog. Additionally, they regularly host webinars and trader interviews in order to facilitate further learning. On their social media, they also post simple tips for traders, especially on Instagram.

They don’t have tools like Pip calculator, lot size calculator, currency converter or economic calendar. In addition to that, they don’t have phone applications like its competitors. So you can’t really see your trading information with a few taps and swipes unfortunately.

Trading Assets and Instruments

MFF offer a diversified number of trading instruments and assets. You can trade 48 forex currency pairs, 4 commodity pairs, 10 indices and 4 cryptocurrencies.

Check the List of MFF Instruments and Contract Specifications.

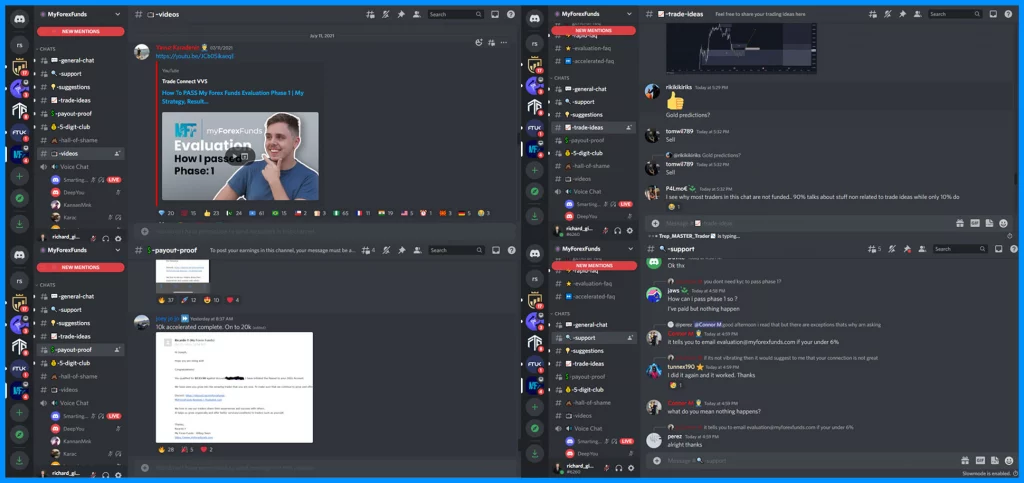

MyForexFunds Discord

MyForexFunds is one of the pioneers in introducing Discord among the prop traders. We found MyForexFunds’ discord server very active and humming with trader interaction. In addition, they organized all the information a trader needed to know in a very dynamic way. According to my experience, I was able to find all the important FAQs in a categorized manner. Furthermore, their categorized chat servers allowed us to communicate and express our opinions. You can look at the image below or visit their Discord for further information to help you understand.

Reputation and My Forex Funds Reviews

As I was learning forex trading 5 years ago, my mentor used to say, “Never compromise with the reputation of a company.” Later in my career, this statement became so important to me. The most positive experience I had on it was with Funding Talent, and you know what happened to them last year. We did a thorough reputation and reliability research on My Forex Funds. We go through multiple layers to ensure that neither I nor MyForexReport suffer under any circumstances.

My Forex Funds Trader Experience:

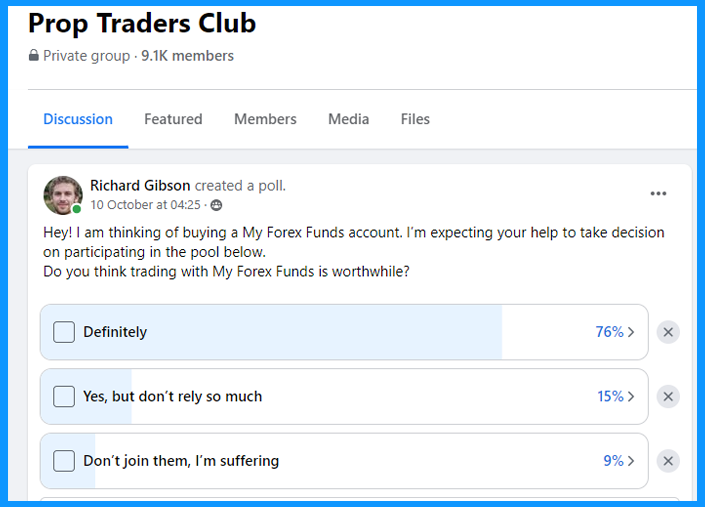

The reputation of a firm is totally determined by the satisfaction of its traders; the higher their level of satisfaction, the more renowned the firm becomes. In the case of My Forex Funds, everything works the same. Let me walk you through a scenario. Before trading with My Forex Funds, our Chief of Trade shared an open pool on Facebook in the Prop Trading Club group asking what they, the traders, suggested to me if I should trade with MFF or not. We got an immense response there and the result is quite expected as 76% of the pool participants voted to join and trade with MFF without a second thought, which, in another respect, is not a wise decision.

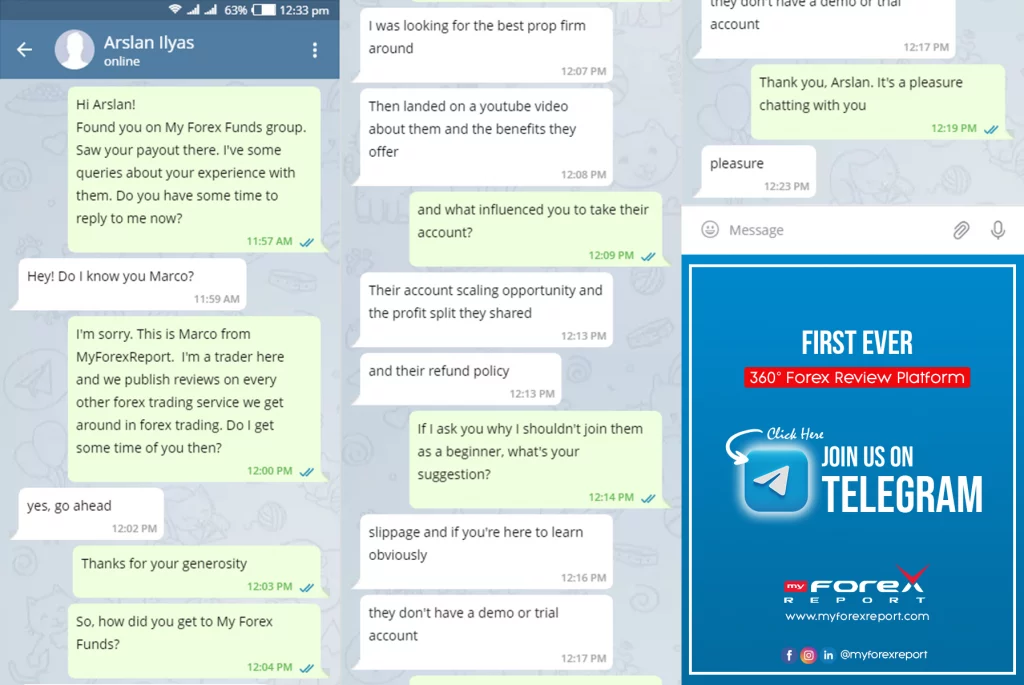

However, besides this, we contacted individual My Forex Funds traders to inquire about their trading experience with My Forex Funds. After approaching a number of them we got Mr. Arslan Ilyas and Mr. Jesus Perez to share their funding experience with us. In the following attachments you’ll find what we’ve talked with them regarding My Forex Funds and their proof of claims.

My Forex Funds Trustpilot:

However, given that we were discussing reputation, it should be obvious to investigate what the general public has to say about a service. Few websites, in my opinion, allow traders the chance to share their opinions as extensively as Trustpilot does. We looked at what the traders at My Forex Funds were saying. In contrast to the pool in the section above, which has a significant positive response, in Trustpilot, we saw how logically My Forex Funds defend their position while looking at the negative response.

My Forex Funds Customer Support:

My Forex Funds provide excellent customer support when they are available. 😅 Yes, their customer service does not provide 24/7 support. You will only receive support during trading days. After the close, you will not receive any kind of support. Another mentionable issue I found is a long queue of people waiting to get support, this could’ve been considered a rare incident but it wasn’t. Many traders on different forums also complained about this since some of them even had to wait 10 to 15 minutes for instant support.

If you ignore such events, then you really can’t complain about the quality of the support. They answered everything I was looking for. Hence better late than never. 🥱

My Forex Funds Alternatives

MyForexFunds and FTMO

| Trading Features | MyForexFunds | FTMO |

| Phase 1 Profit Target | 8% | $1,000 |

| Phase 2 Profit Target | 5% | $500 |

| Maximum daily loss | 5% | $500 |

| Maximum Loss | 12% | $100 |

| Minimum trading days | 5 days | 10 days |

| Leverage | 1:100-1:500 | 1:100 |

| Profit Split | Up to 85% | Up to 90% |

| Minimum Account Opening Fees | $49 Account Size: $5,000 | €155 Account Size: $10,000 |

| Maximum Account Opening Fees | $1,389 Account Size: $300,000 | €1,080 Account Size: USD 200,000 |

| EA Trading | Allowed(at your own risk) | Allowed(at your own risk) |

| News Trading | Allowed | Allowed |

MyForexFunds and E8 Funding

| Trading Features | MyForexFunds | E8 Funding |

| Phase 1 Profit Target | 8% | 8% |

| Phase 2 Profit Target | 5% | 5% |

| Maximum daily loss | 5% | 5% |

| Maximum Loss | 12% | 8% |

| Minimum trading days | 5 days | NA |

| Leverage | 1:100-1:500 | 1:100 |

| Profit Split | Up to 85% | Up to 80% |

| Minimum Account Opening Fees | $49 Account Size: $5,000 | $228 Account Size: $25,000 |

| Maximum Account Opening Fees | $1,389 Account Size: $300,000 | $988 Account Size: $250,000 |

| EA Trading | Allowed(at your own risk) | Allowed(at your own risk) |

| News Trading | Allowed | Allowed |

Things That My Forex Funds Should Improve

Despite being one of the top proprietary firms on the market, My Forex Funds still has room for improvement. Since I’ve been trading with them for the past few months, I’ve gathered a list of things they need to work on. If they plan and organize things effectively, they can use their current market share to become a touchstone.

- Workspace

A trader can easily assume that the company or organization they are trading for has a professional setup, a central workspace, or an office. We initially assumed that My Forex Funds would operate from a central hub as well, but their customer service later confirmed that they are actually operated remotely. This inevitably leads to the notion that since they work remotely, their services and support won’t be as effective, which we will further discuss in the following sections. However, My Forex Funds should have an onsite office since it is acknowledged as a leading forex proprietary firm. As a trader, we believe this will increase their credibility and growth exponentially. - Tools and Apps

The absence of tools and applications was the most upsetting part of the MyForexFunds experience. Both on their website and in their dashboard, we could not find any tools like a pip calculator, lot size calculator, margin calculator, swap calculator, or even a currency converter. We all understand how important these tools are, but in order to use them, we had to visit other websites to do the calculations, which sometimes took a lot of time. In addition, newcomers like E8 Funding offer apps for their traders, but unexpectedly, despite being widely known, MyForexFunds does not. I truly hope they address this, since there is always a risk of getting eliminated by other market competitors. - 24/7 Customer Support

Another setback of MyForexFunds is their Singapore-based customer support, which is not available 24/7 and has a long waiting queue. As we mentioned before, there are drawbacks to not having a central workspace, and customer service may be one of the main ones. A company’s growth would be challenging to achieve without considering customer satisfaction.

Is MyForexFunds Legit or Scam?

In my experience, there is no way I can tell you that MyForexFunds is a scam. MyForexFunds have duties towards us and we also have to take into account our losses. Although we are aware that some firms bear a portion of the blame for trader losses, we as traders bear a large share of the blame as well. Even if we lose money even though we have a good trading plan and strategies, we can never call a fund provider a scammer.

MyForexFunds Review Conclusion:

MyForexFunds offers quite a good opportunity for all types of traders but there is always room for improvement in the trading business. MyForexFunds needs to make a number of improvements as they are setting the bar high with some of the other services they offer to traders. We believe they are a company that would be difficult to beat if they commit to the findings we have derived from our experience.

Happy Trading! ❤

MyForexFunds Frequently Asked Questions

Read detailed MFF FAQ section updated for 2022.

MyForexFunds are not a broker. Therefore, they do not require regulation as they are a proprietary firm. They use their own server, Traders global group for all MFF accounts, both challenge phase and live accounts. It is provided by an institutional fintech company that also provides liquidity.

Our research and experience can confirm to you that MyForexFunds did not show any signs of being fraudulent or untrustworthy. Anyone with the following link: https://opencorporates.com/companies/ca/12646170 can verify their legality since we have also verified their legitimacy in Canada. In addition, they handed us the profit split timely and accurately. Therefore, it is impossible to label them as an unreliable prop trading firm.

They accept payments by credit/debit card and cryptocurrency.

Signing up myforexfunds is easy. Select the MFF program and account size that best suits your trading style. Complete your registration by paying the one-time registration fee. Your login credentials should be sent to your email automatically.

The MFF allows you to use a trade copier as long as you are copying your own trades. The use of trade signals or copying trades from another source is not allowed.

You can request your payout by:

1. If you want to receive your payout in cryptocurrency, you can select BTC, LTC, ETH, or USDC.

2. With Deel, you can request your payouts with Paypal, bank transfer, Payoneer, Revolut, Mercury, etc.

Leave feedback about this